By Martin Rowell

So the main purpose of this blog post is to look over the data a new product and analyize the product’s performance over the first year and address the question, “Is this product meeting expectations?”

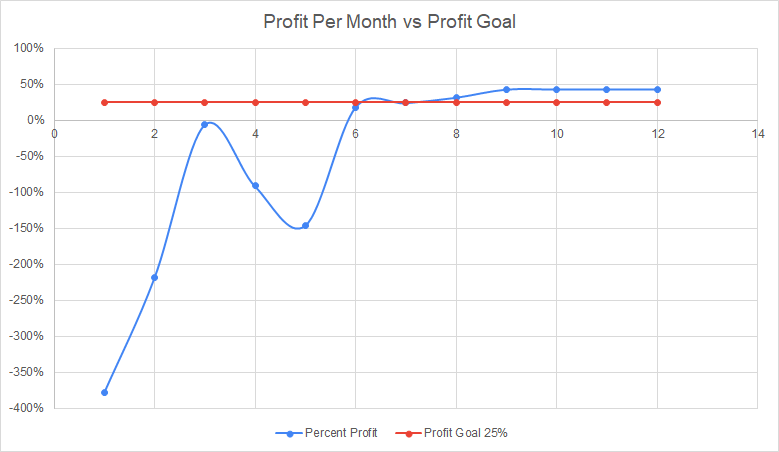

Now the first thing we have to clarify is what are we seeing as meeting expectations? Well, to put it simply, the expectation is the product is generating a 25% margin meaning that the profit that is generated by this product is about 25% of the revenue. Now if we were to look at the year end average for this product, the product margin is about 4%, but does this really mean that the product is not meeting expectations? Remember, this is the first year of the product being released, and there is always a chance that a new product may have a rocky start. To see how the product did per month compared to the product expectation of 25%, and from what I can see the product was very far from meeting the expectation; however, around the seventh month the product was then going beyond the product’s expectation.

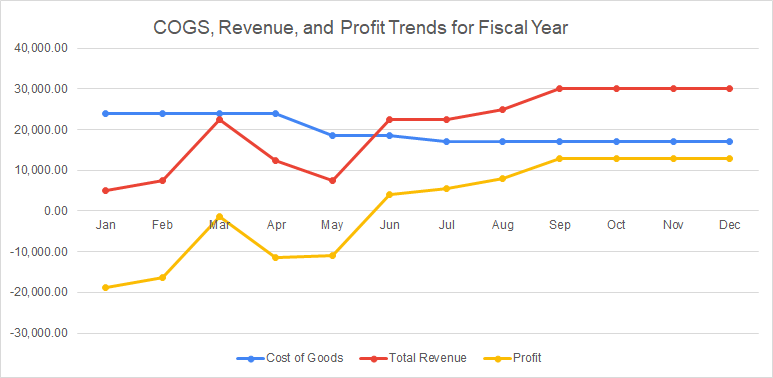

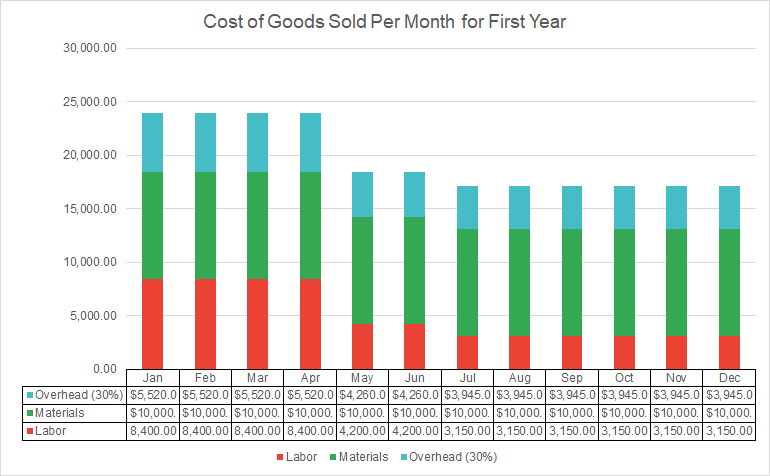

So the next question is what caused the this product to go from not meeting their to goal to exceeding their goal? If we look at the same time line, we can see that revenue began to sharply jump after May and then hit three consecutive months in the last quarter of $30K in revenue sales. We also see that around April, the cost of good sold began to drop and flatten at around $17K. The three major components for cost of goods sold is labor, materials, and overhead which is set at 30% of the labor and material costs. What we see when we break down the costs is that labor drop significantly and with it our overhead costs as well resulting in a cheaper cost per unit.

The rise in revenue and the decrease in cost of goods sold both played a role in increasing the profit and lifting the product above the expectation of 25% profit.

Now we have to go back to the question of “is this product meeting expectations?” Now if we look at just the year average the answer is a clear no. When we look at the development of product over the year though we saw a pivot for the better halfway through the year and then a consistent drop in cost of good sold and revenue in the last quarter. With that said, I think this product may not have been meeting expectation at the start of the year but it is clear that by they end the product was not only meeting, but exceeding, the 25% profit margin expectation. This product was able in it’s last quarter consistently perform above expectations, and I think that this tend will continue in the product’s second year.